What is bridge Financing

Bridge financing is a well-established funding tool that allows property entrepreneurs to seize real estate opportunities.

Bridge loans are applied to commercial or residential purchases allowing for swift execution on property deals take advantage of short-term opportunities in order to secure long-term financing.

Bridge loans are typically paid back when the property is sold, refinanced with a traditional lender, improved or completed, or a specific change that allows for a subsequent round of mortgage financing to occur.

Main features:

- Typically have a higher interest rate.

- Lenders may require cross-collateralization and a lower LTV ratio.

- Normally short-term, 3 to 12 months.

- More profitable.

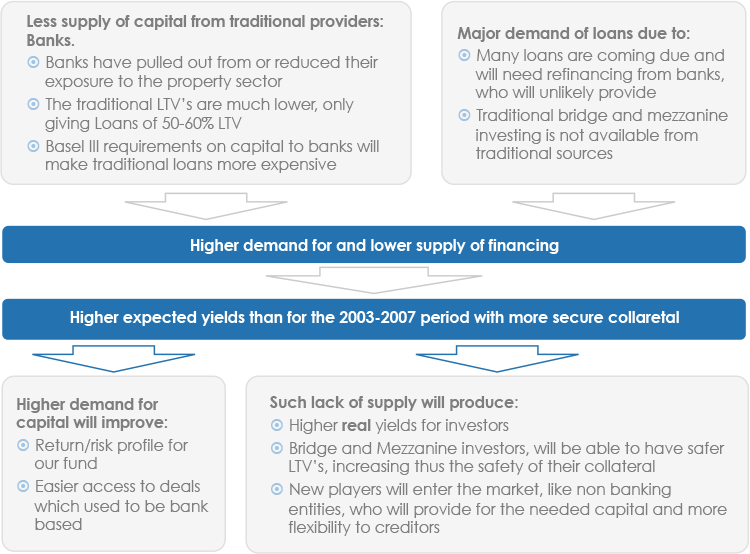

The case for bridge financing